Personal finance management is more important than ever in today’s busy world. Tracking all of your spending and paying all of your bills can quickly become too much. Luckily, online payment options have made it easier than ever to keep track of your money. Managing your money, paying your bills, and keeping your financial health in check is easy and quick with these tools. Here are a few ways through which online payment solutions help you enhance your personal finances.

Easily Paying Bills

Using online payment methods has changed the way we do business with money. Paying your bills doesn’t have to mean writing checks or going to several places. Everything can now be managed from home or while you’re out and about. Money transfers, buying, and debt settlement can all be done with just a few clicks. Additionally, this saves time and lowers the chance of mistakes and late payments, guaranteeing that your financial responsibilities are met on time.

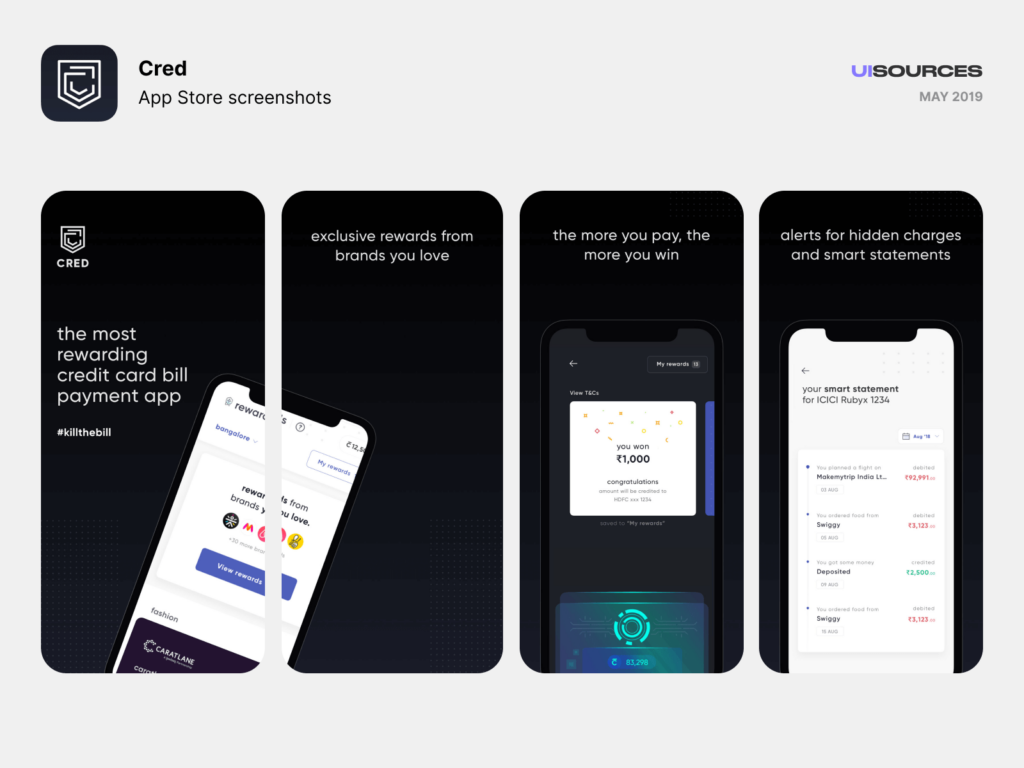

Easily paying bills online is one of the best things about using online payment services. You can complete all of your tasks in one location, including paying your credit card bill, water bill, or power bill. You can set up regular payments on many platforms, so you never have to worry about missing a due date anymore. Maintaining a good credit score is easier with this technology because it makes sure payments are made on time and late fees are avoided.

Complete Financial Information

Additionally, online banking apps give you a complete picture of how you spend your money. You can easily see where your money is going with these apps because they sort your spending into different categories. Using this information to look at your spending can help you make smart choices, create budgets, and find places to save money. If you want to get better at managing your money and reach your financial goals, this amount of information is priceless.

Higher security

Better protection is another benefit of using online payment options. Secure servers and advanced encryption technologies keep your private information safe on these sites. Multiple security measures, like two-factor authentication, are built into many apps to keep your banking information safe. Without worrying about your personal and financial information being stolen, you can easily make purchases.

Beyond Paying Bills

Making the payment online is convenient for more than just paying bills. People can give money to family and friends, split costs, and even invest in different types of financial instruments using these sites.

With the online payment app now integrating with investment platforms, you can handle your investments and keep an eye on how they’re doing right from the app. Having this integration makes it easier to keep track of your money and manage your general financial portfolio.

Worldwide Accessibility

Additionally, online banking options let you handle your money from anywhere in the world. Although you may be going for business or pleasure, you can still make sure that your financial obligations are met and your bills are paid. There is no need to be physically present to handle your finances, which is especially helpful for people who are always on the go.

Conclusion

Thanks to online payment options, keeping track of your personal finances has never been easier. Of the many benefits these tools provide, some of the most important are ease of use, increased protection, and detailed financial information. You can make better decisions about your spending and saving habits, make managing your money easier, and make sure you pay bills online on time by using these tools. Take charge of your financial future today by using online payment apps.